Click Here for 150+ Global Oil Prices

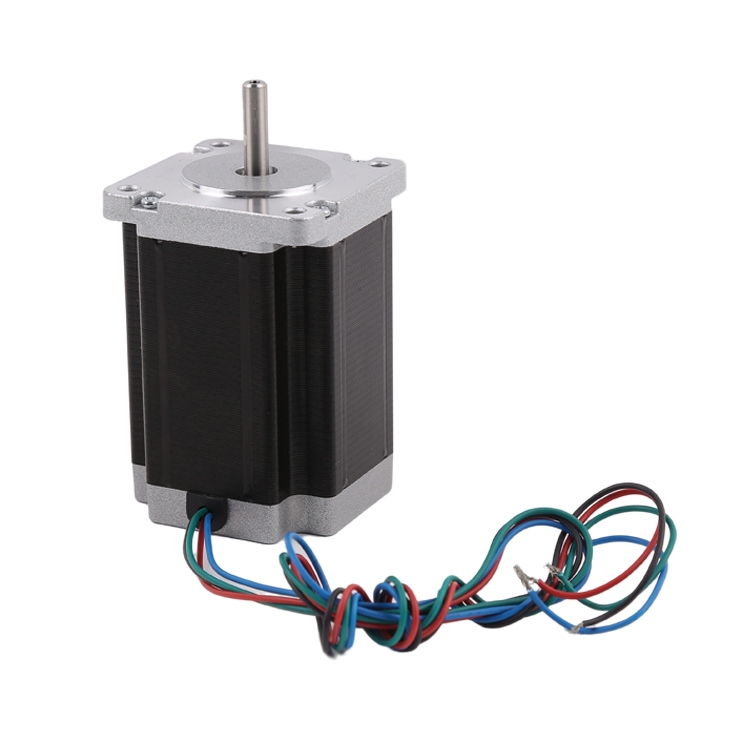

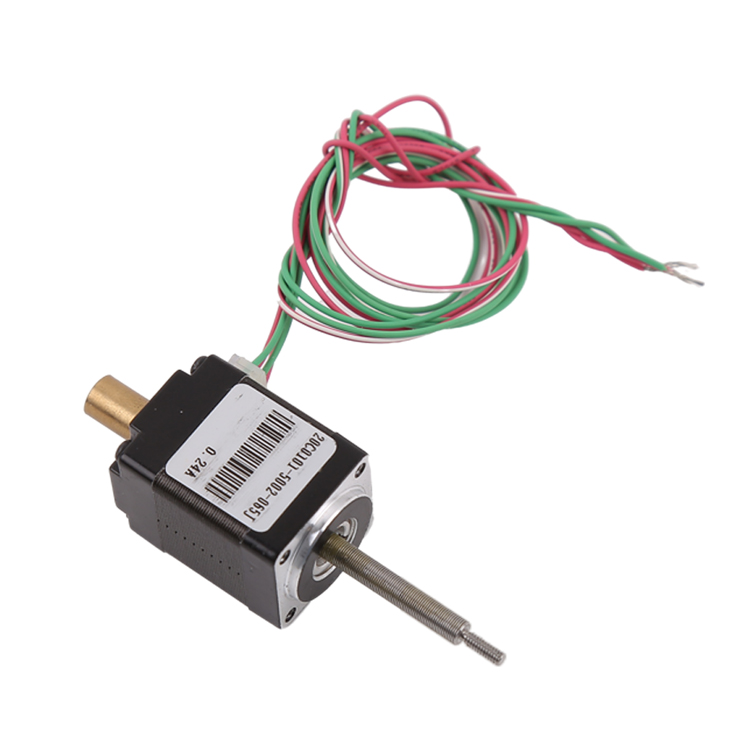

Start Trading CFDs Over 2,200 Different Instruments China motor step

Click Here for 150+ Global Oil Prices

Click Here for 150+ Global Oil Prices

Start Trading CFDs Over 2,200 Different Instruments

Click Here for 150+ Global Oil Prices

Click Here for 150+ Global Oil Prices

Start Trading CFDs Over 2,200 Different Instruments

Click Here for 150+ Global Oil Prices

Click Here for 150+ Global Oil Prices

Start Trading CFDs Over 2,200 Different Instruments

Click Here for 150+ Global Oil Prices

Oil Prices Steady Before Holiday

China has imposed export controls…

The COP28 agreement in Dubai…

The leading economics blog online covering financial issues, geopolitics and trading.

What do you get after a decade of negative real rates and unlimited QE as monetary policy? Losing $227,000 per vehicle as an acceptable business model for an automobile company!

At least that's the case over at Lucid, according to a new writeup from the Daily Caller.

The California-based Lucid Motors, offers four electric vehicle (EV) models priced between $74,900 and $249,000 and reported a third-quarter net loss of $630.9 million, excluding overhead costs.

This amounts to over $227,000 in losses per car sold, the report says, citing its financial statements and calculations by The Wall Street Journal.

Despite having sold only 125 vehicles by November 2021, the company's valuation peaked at $91 billion. However, its stock price has since dropped by approximately 93%.

Last week, Lucid Motors reduced its vehicle prices to boost demand, the report notes. All the while, the electric vehicle company's primary investor is the Saudi Arabian public investment fund, ironically sustained by oil revenues.

The Saudi government plans to purchase 100,000 Lucid cars over ten years, with the fund investing heavily to support the struggling company, the report added.

Lucid is not alone in its financial struggles within the EV sector. Rivian, another upscale EV maker, faced a loss of $33,000 per vehicle sold in the second quarter. Meanwhile, Ford, a traditional automaker, anticipates over $4 billion in losses from its EV division this year.

More Top Reads From Oilprice.com:

Europe’s Natural Gas Prices Rise As Traders Weigh Winter Supply Risks

Green Ammonia Breakthrough to Transform Fuel and Fertilizer Industries

The leading economics blog online covering financial issues, geopolitics and trading.

U.S. States Make Bold Move to Reclassify Gold and Silver

The Top 5 Oil Producers of 2023

Copper Prices Waver as Global Supply Faces New Challenges

What’s Driving America’s New Oil and Gas Boom?

U.S. Nuclear Sector Set for Major Transformation

The materials provided on this Web site are for informational and educational purposes only and are not intended to provide tax, legal, or investment advice.

Nothing contained on the Web site shall be considered a recommendation, solicitation, or offer to buy or sell a security to any person in any jurisdiction.

Trading and investing carries a high risk of losing money rapidly due to leverage. Individuals should consider whether they can afford the risks associated to trading.

74-89% of retail investor accounts lose money. Any trading and execution of orders mentioned on this website is carried out by and through OPCMarkets.

Nema Motors Merchant of Record: A Media Solutions trading as Oilprice.com